What should the CFO and the finance team be prioritising?

Added Friday 10 September 2021 by MHR Analytics

With so many things going on in and around the CFO and the finance team, it is easy to get drawn into day-to-day operations and lose sight of the medium to long term. So, what are other senior finance professionals identifying as priorities in the coming months? In this guest post, MHR Analytics look at what the analysts are saying based on their research.

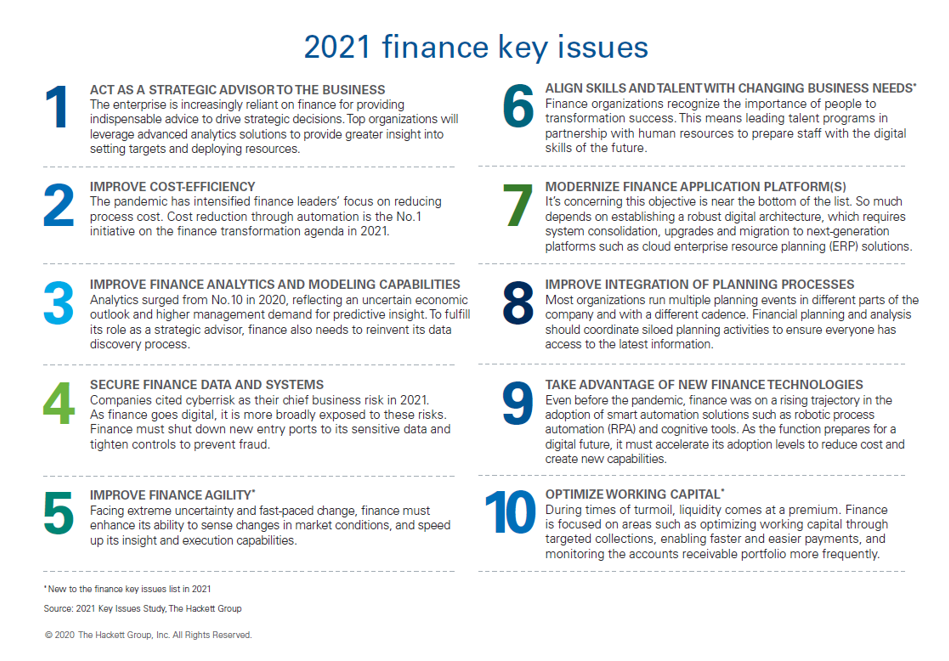

The Hackett Group are a leading analyst and research group who released their ‘2021 Key Issues’ research in Dec 2020.

This report presents the results of their research at a strategic level and identifies 10 key issues (not necessarily in order of importance).

The need for the finance team to be more strategic is a common theme with the pandemic intensifying this, making it an imperative rather than a nice to have. Advanced analytics is mentioned as a means to achieving this through the provision of greater insight.

We have seen an increase in pressure on the finance team to improve productivity and become more ‘cost-efficient’. The phrase ‘cost-efficient’ better describes what we should be aiming for, not just ‘cost saving’ which results in completely different outcomes. One way of achieving this is through automation, identified as the top initiative for 2021.

There are two newcomers to this list which is published annually. The need to ‘improve finance agility’ and ‘align skills and talent with changing business needs’ have become apparent during the pandemic because of fast-paced change and the need for transformation.

Figure 1: FP&A priorities for 2021 Source: 2021 Key Issues Study, The Hackett Group

As we might expect, planning and reporting is going to be key, with the need to improve analytics and reporting capabilities as the pandemic has exposed weaknesses in both areas. To this end, we need to improve analytics and modelling capabilities as well as integrate the planning process across the organisation.

And how do we achieve this? Well, taking advantage of new technologies such as Robotic Process Automation (RPA) and advanced analytics tools. Adoption of these needs to be accelerated to address the key issues. Alongside this, we need to upskill and train staff as the business changes.

If we take a look at Gartner, they recently released ‘The Top Priorities for CFOs and Finance Leaders in 2021’ research report. This report provides more granular detail, split by CFO, FP&A and Controller respondents and by task/process.

When it comes to the CFOs digital priorities and where they expect to spend most of their efforts, top of the list is advanced data analytics.

The criticality of data and analytics has been apparent during the crisis. What is also accepted is the difficulty of achieving a level of excellence in this area. It requires potential investment in technology, if tools are not already in-situ, and the digital skills to operationalise this. Hence, accelerating the digital skills levels of the finance team is also likely to require additional time. Interestingly, AI appears to be less important, perhaps reflecting the need for organisations to improve the basic processes before embarking on more advanced technology projects.

With the pressure on cost and productivity of the finance team, it is not surprising that RPA appears high on the list of anticipated time spent.

The hands-on, operational role of the FP&A team is reflected in their responses. There is alignment with the CFO in respect of advanced data analytics. As expected, we also see the importance of planning with scenarios and model design identified as areas where time will be spent by the team. This suggests that current planning processes do not meet the needs of many organisations and require further development. Business Partnering activities also feature highly with the improvement of skills and cross-functional insights.

As we would expect, Controllers have slightly different priorities, reflecting their governance driven role. Again, advanced data analytics is seen as priority. However, we also see the importance of improving productivity in this function with the need to spend time on automation featuring highly.

What comes out in the detail of the report, is the growing importance of staff engagement and retention. It is essential that organisations identify, recruit, train and develop the members of their finance team and then ensure they stay with the organisation to reap the benefits of this investment.

However, there is one point of confusion in the Gartner report. It suggests that most CFOs expect pressure to reduce the overall cost of the finance team in order to fund growth in others. Many of the high priority strategies are likely to require an investment. What Gartner does not elaborate on is how to achieve the reduction in cost of the finance team whilst pursuing the other digital priorities.

Conclusions

What is of comfort is that both analysts are raising the same issues and identifying the same priorities.

It is clear we must address the cost-efficiency of the finance team by automating processes, creating the time for advanced analytics. We must improve our planning capabilities, increasing agility and resilience. We need to adopt a more integrated approach and become trusted partners to the rest of the

How do we achieve this? Through embracing technology and accelerating digital business initiatives. And we need to take our staff with us on this transformation journey by empowering and equipping them with the digital skills of the future. If we do this, attracting and retaining the right staff will look after itself.

More Information

If you’d like hear more about this, please complete the form below: